13 Actor Expenses to Budget For | Unexpected Costs of Being An Actor

Managing finances as an actor can be challenging, especially with the unpredictable income and numerous expenses that come with the profession.

Trust me, I know. I’ve spent thousands of dollars on headshots, classes, workshops, acting profiles, and more! Those actor expenses add up.

Knowing what to expect financially from training to marketing, and audition-related costs can help you budget more effectively.

If you plan, you can manage those actor expenses like a pro…or at least a semi-pro.

Training and Education Costs

1. Acting Classes (Recurring/Seasonal)

One of the most consistent expenses for actors is acting classes. These can be ongoing or seasonal, depending on your career stage and goals.

Costs vary widely, but expect to pay anywhere from $200 to $500 per course.

Budgeting for these classes ensures continuous growth in your craft.

2. Workshops and Seminars (One-time or Occasional)

Workshops and seminars are great for networking and learning from industry professionals.

These are usually one-time actor expenses, but can occur several times a year. Prices range from $50 to $500 per workshop.

Prioritize workshops that align with your career goals to maximize your investment.

3. Private Coaching (As Needed)

Some roles or auditions may require private coaching, especially for dialect work or character development.

These are typically hourly actor expenses, ranging from $50 to $250 per hour, depending on your coach.

Marketing and Promotional Expenses

4. Headshots and Photography (Annual/Bi-Annual)

High-quality headshots are essential for auditions and casting calls.

These typically need updating every 1-2 years. Expect to pay between $200 and $1,000, depending on the photographer and package.

Choose a photographer experienced in actor headshots to ensure industry standards are met.

5. Demo Reels (Occasional Updates)

Demo reels showcase your acting range and are essential for auditions.

Updates are needed whenever you have new, significant footage. Professional editing services cost between $200 and $800.

If you’re tech-savvy, consider editing your own reel to save money.

6. Website Maintenance (Annual)

Having a personal website is a good way to keep control over your personal brand.

Domain and hosting fees range from $100 to $300 annually.

In my opinion, your website shouldn’t just be a place for your marketing materials to live. It should be monetized and used to build your brand!

My website, for example, which you are on right now, helps me earn income and serves as a central hub and source of truth for my brand.

7. Postcards To Casting Directors

One actor marketing method taught by actors like Mark McCullough involves sending out unsolicited postcards to casting offices showcasing your recent work.

This can be a great way to get your name out there and become known throughout the various casting offices across the country.

The cost of this depends on how many postcards you send out and what services you use. If you’re sending out 20 cards to 20 casting offices, for example, you could spend around $40-$60.

Audition-Related Costs

8. Casting Website Subscriptions (Monthly/Annual)

Casting websites are crucial for finding audition opportunities and are the most common and continuous of actor expenses in my opinion.

Popular sites like Actors Access, Backstage, and Casting Networks charge monthly or annual subscription fees ranging from $10 to $25 per month.

Consider which sites are most relevant to your market before subscribing to all of them.

9. Wardrobe for Headshots/Auditions/Projects (Occasional)

Specific roles often require a particular look, necessitating wardrobe purchases.

This actor expense is occasional but can add up if multiple auditions require unique outfits.

Opt for versatile clothing pieces that can be mixed and matched to save on wardrobe costs.

10. Self-Taping Equipment and Software (One-time/Upgrades)

Self-taped auditions have become increasingly common, requiring a good camera, lighting, and editing software.

Initial costs range from $200 to $1,000, depending on quality.

I’ve used my iPhone 15 Pro for a while, and that works fine for me. I’ve had the same tri-pot for like 10 years, and it’s never let me down!

Check out my list of physical actor tools to add to your toolkit.

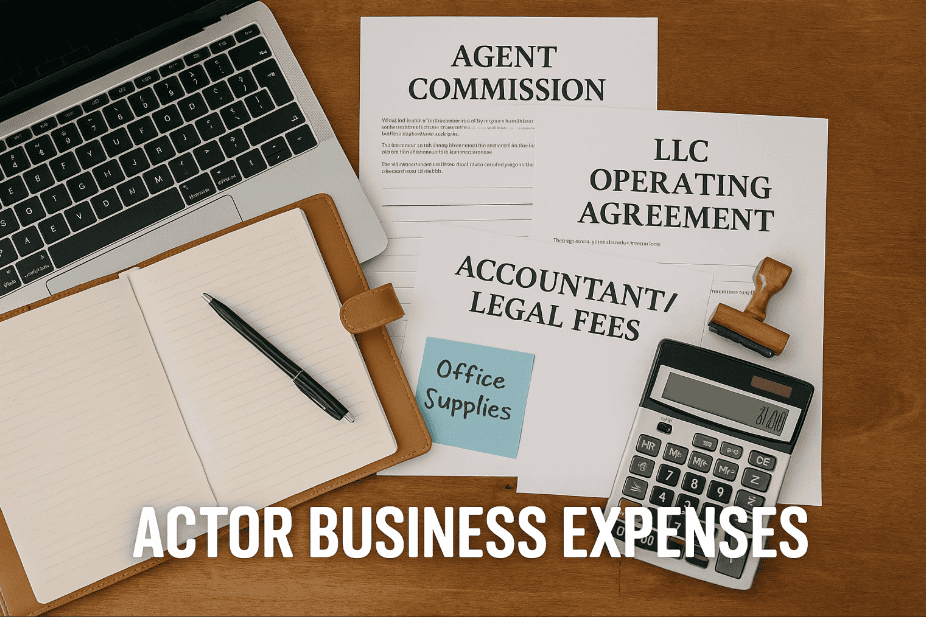

Business Expenses

11. Talent Agent and Manager Commissions (Percentage of Earnings)

Agents and managers typically earn 10-20% of your earnings as commission.

This expense only applies when you book jobs, so it’s important to budget accordingly.

Understanding contract terms helps avoid surprises when paying out commissions.

12. Accountant and Legal Fees (Annual/As Needed)

Tax season often requires hiring an accountant familiar with actor finances.

Legal fees may also arise for contract reviews. These expenses vary but are typically annual or as needed.

Investing in professional advice can save money in the long run by ensuring accurate tax deductions and contract terms.

If you’re not making much money as an actor, then you likely don’t need to worry too much about this for now.

But doesn’t hurt to bring it up with your tax preparer.

13. Office Supplies and Software (Occasional)

Office expenses such as stationery, software subscriptions, and other administrative tools are occasional but necessary.

These costs are usually minimal but should be factored into your annual budget for actor expenses.

Union Fees

Initial Fees and Annual Dues (Variable)

Joining SAG-AFTRA is a significant milestone, but it comes with expenses. Depending on the region, initial fees can range from $3,000 to $3,500.

After joining, annual dues are approximately $220 plus a percentage of your earnings.

When and Why Actors Join SAG-AFTRA

Actors typically join SAG-AFTRA after gaining experience and eligibility through union jobs.

While joining provides benefits like healthcare, pension, and better pay, it also limits you to union-only work.

Weigh the pros and cons before making this financial commitment.

Conclusion

Acting comes with unique financial challenges, but understanding regular actor expenses can help you budget more effectively.

From training and marketing to union fees and audition costs, being prepared makes a significant difference.

By implementing smart budgeting and financial planning strategies, you can confidently navigate the financial side of an acting career.

Actor expenses are only scary if yo make them 🙂

Stay scripted, stay savvy!

Frequently Asked Questions

What tools can help actors manage their finances?

Financial tools like YNAB (You Need a Budget), Mint, and QuickBooks Self-Employed are excellent for tracking income, expenses, and tax deductions, helping actors manage their finances more effectively.

Are acting classes tax-deductible?

Yes, acting classes are generally tax-deductible as a professional expense if they enhance your existing skills. Consult with a tax professional familiar with actor finances for accurate deductions.

What are the most common actor expenses?

The most common expenses for actors include acting classes, headshots, demo reels, casting website subscriptions, and self-taping equipment. These are essential for building and maintaining a professional acting career.

How do actors budget with inconsistent income?

Actors can budget with inconsistent income by setting up an emergency fund, creating a detailed monthly budget, and using financial planning tools to track expenses and savings goals.

How can actors save money on headshots and demo reels?

Actors can save money by bundling headshot sessions with demo reel footage, choosing photographers who offer package deals, or learning basic video editing to update demo reels independently.

What expenses can you claim as an actor?

As an actor, you can typically claim tax deductions for expenses that are directly related to your work, including headshots, audition travel, acting classes, self-tape equipment, union dues, agent commissions, marketing materials (like postcards or websites), wardrobe used exclusively for performances or auditions, and home office costs if you work from home. These write-offs generally apply if you’re self-employed (1099 income); W-2 employees have more limited options. Always keep receipts and records to back up your claims.